Trading remained cautious yesterday, but investors snapped up defensive plays and bargain counters amid hopes of a US rate cut, giving the market a lift.

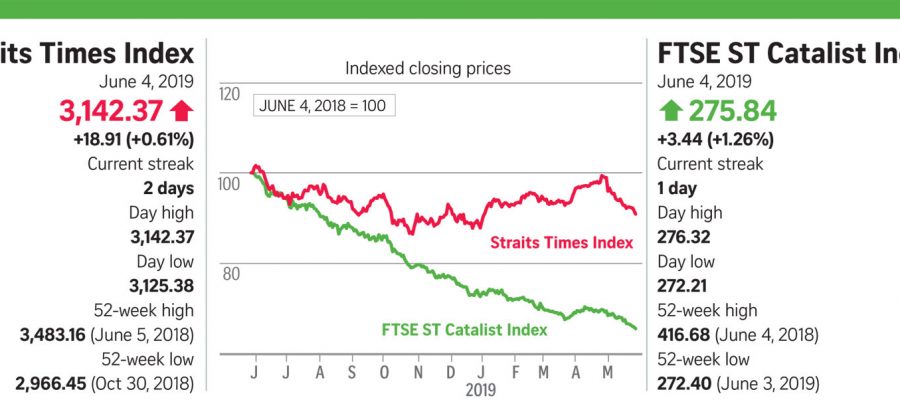

The Straits Times Index (STI) built on Monday’s gains to close up 18.91 points, or 0.61 per cent, to 3,142.37.

Trading volume here clocked in at 921.38 million shares worth $1.04 billion, with gainers outpacing losers 210 to 152. Only six of the 30 benchmark shares were in the red.

While the local market enjoyed some reprieve, trade and economic worries dominated global sentiment. The effects of tariffs between the United States and China have been reflected in weaker Purchasing Managers’ Index (PMI) figures for last month, an indicator often used to anticipate economic growth.

That said, CMC Markets analyst Margaret Yang noted that the “negative implications of weak manufacturing PMI readings across the region were cushioned by a weaker US dollar, which alleviated capital outflow from emerging markets”.

Trading across the region was mixed. Australia posted gains while Japan ended flat. China, Hong Kong and Malaysia ended lower, as did South Korea, which saw slight losses after three sessions of gains on weak gross domestic product data.

Singtel was the STI’s most traded stock, with 21.5 million shares changing hands. It gained 0.6 per cent to $3.21 as investors focused on its defensive appeal.

The banks were also up. United Overseas Bank was up 1.7 per cent to $24, while DBS added 0.9 per cent to $24.27 and OCBC Bank gained 0.4 per cent to $10.63.

Market watchers noted that the lenders were oversold last month and are trading at attractive valuations and enjoying a rebound.

Talk from a leading US banker that an interest rate cut may be warranted soon sparked interest in real estate investment trusts (Reits) here. CapitaLand Commercial Trust, which gained 0.5 per cent to $1.99, and Mapletree Logistics Trust, which added 2 per cent to $1.50, were the most active Reits.

As oil prices headed for bear territory, investors eyed attractively valued counters in the sector like China Aviation Oil (CAO), which added 3.3 per cent to $1.27.

UOB Kay Hian trading representative Brandon Leu noted: “Investors may be using the recent sell-off to pick up CAO in view of the… possible rebound in oil prices.”

Construction firm Tiong Seng Holdings gained 8.7 per cent to 25 cents after entering a deal to dispose of its 55 per cent stake in Chinese unit Jiangsu Huiyang Construction Development for 67 million yuan (S$13.3 million).