Local shares faced heavy selling yesterday and clocked up their worst weekly performance since August 2011 as the virus outbreak went global after initially being seen as an Asia-centred event.

Sentiment had already taken a beating as cases in South Korea and Italy surged while American health officials expect a sustained spread of the virus to take root there.

Investors now fear the economic fallout from Covid-19 could lead to a global recession.

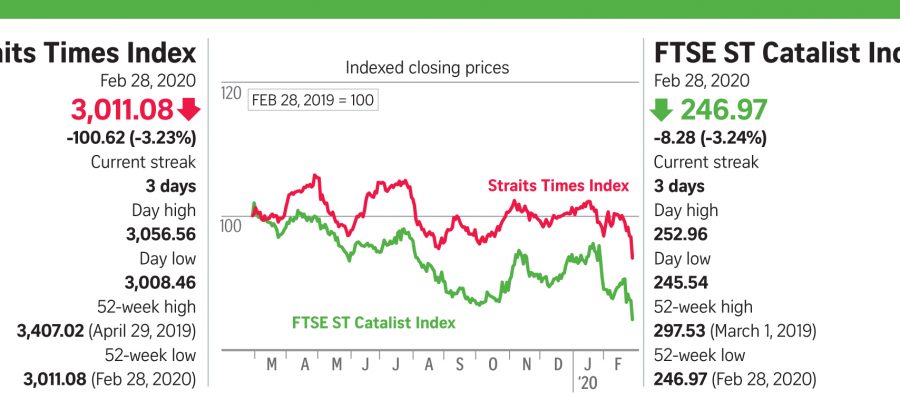

The Straits Times Index (STI) finished at 3,011.08 after diving 100.62 points or 3.23 per cent.

This is the STI’s lowest closing since Oct 3, 2018 and sharpest single-day drop since August 2015. It was down a thumping 169.95 points or 5.3 per cent for the week and off 4.5 per cent for February – its biggest monthly loss since August last year.

Trading volume stood at 4.06 billion shares worth $2.93 billion with losers outpacing gainers 463 to 103.

All 30 of the STI’s constituents closed in the red.

Venture Corp fell 0.4 per cent to $16.45. The contract manufacturer reported on Thursday night that fourth-quarter net profit fell 10.6 per cent to $96.3 million but revenue rose 2.9 per cent to $932.1 million.

While the coronavirus outbreak could spell a weak first quarter for Venture, DBS Group Research analyst Ling Lee Keng said the company expects a better second quarter as more customer orders will be fulfilled and backlog cleared.

A stronger second half is on the cards due to new product introductions and new partners coming onstream, she noted yesterday.

Meanwhile, the banks all ended lower. DBS lost 2.9 per cent to $24.11, United Overseas Bank fell 3.1 per cent to $24.48 and OCBC Bank skidded 2.8 per cent to $10.60.

“Following sell-offs this week, the banks are now trading at a dividend yield of more than 5 per cent but in the current environment, shares could still go lower,” a trader said.

Golden Agri-Resources fell 2.4 per cent to 20 cents. The agribusiness firm tripled fourth-quarter net profit to US$239.6 million on the back of higher palm oil prices.

Citi Research analyst Patrick Yau expects palm oil to be less impacted by the virus outbreak, given that most demand comes from food needs. However, he said a prolonged disruption could present risks if energy prices are depressed.

Elsewhere, Australia, China, Japan, Hong Kong, Malaysia, South Korea and Taiwan all closed down. The Shanghai Composite Index and Japan’s Nikkei 225 fared the worst, each slumping 3.7 per cent.